Voya is the university’s voluntary benefits vendor, offering robust coverage including critical illness, accident, and hospital indemnity benefits as well as critical illness coverage level for dependent children.

The critical illness benefit offers employees coverage options of $10,000 or $20,000, with spouses eligible for 50% of the employee’s benefit. Dependent children can also receive 50% of the employee’s coverage.

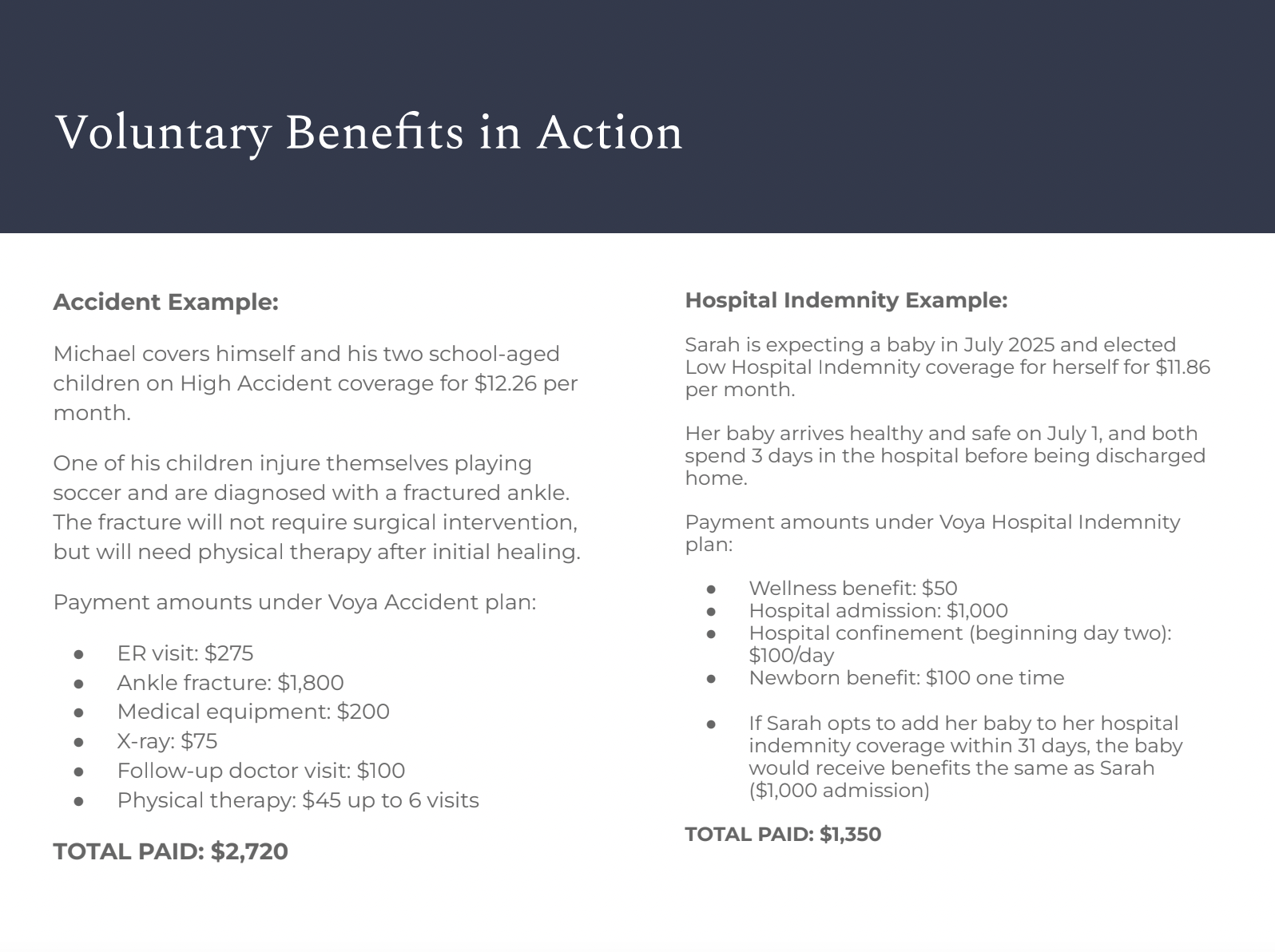

The accident benefit offers low and high coverage options, available for employees, spouses/partners, and dependent children.

The hospital indemnity plan offers low and high benefit options for employees, spouses/partners, and dependent children. This plan provides a fixed daily benefit for hospital, critical care, or rehab stays, along with a $50 wellness benefit for each covered individual. There is also an additional newborn benefit.

Explore the plans in more detail below.